The rise of private credit in Asia

Overview of private credit in Asia

Private credit refers to the provision of loans to companies, typically small and medium-sized enterprises (SMEs) without investment-grade credit ratings, by non-traditional lenders such as private equity firms and hedge funds. It is the alternative to debt financing from banking institutions or capital markets.

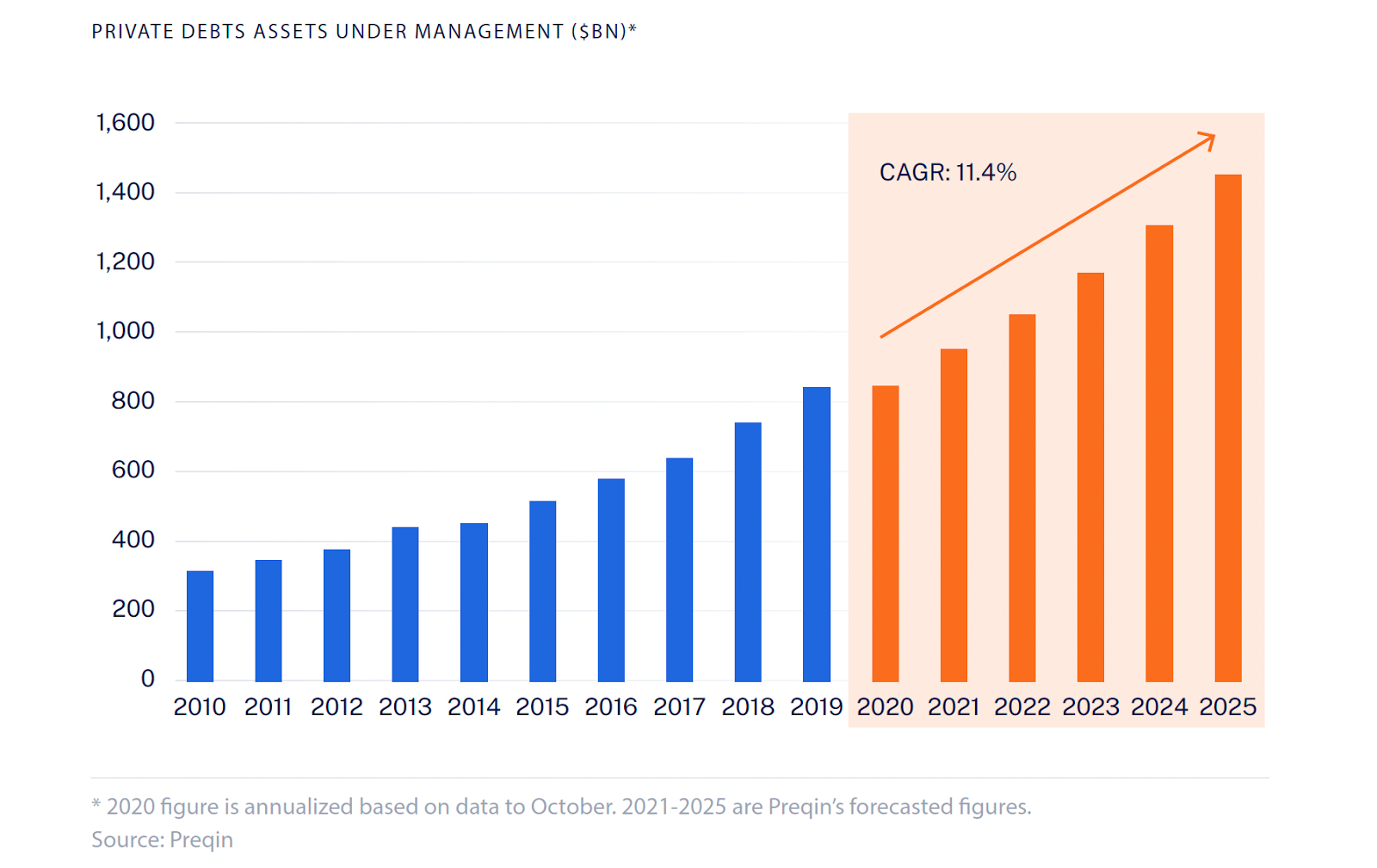

Over the past decade, private credit has experienced unprecedented growth, expanding from US$320 billion in 2010 to US$875 billion in 2020 (measured in assets under management (AUM) figures) as reflected in the graph from Preqin below. Private credit is now the third-largest asset class in the alternatives space, closely following private equity and real estate. It is further projected that there will be an 11.4 per cent compound annual growth rate of private credit from the end of 2020, which would take the total AUM of private credit to nearly US$1.5 trillion in 2025.

Asia is no exception to witnessing the rising prominence of private credit, where AUM of private credit doubled between December 2014 and June 2019 to around US$57 billion. [1] Leading private credit manager, Blackstone, is expecting a tenfold increase of assets in its Asia-Pacific private credit business as companies in the region eagerly look to diversify debt financing away from bank loans. [2]

Macroeconomic tailwinds for the rise of Asian private credit

The challenging lending environment created by regulatory changes at banks

Banks in the Asia-Pacific region have become more cautious and risk-averse since the 2008 global financial crisis, leading to greater scrutiny of borrowers and tighter lending standards in order to lower the level of exposure on their balance sheets while adhering to Basel II capital requirements.

This regulatory change has made it more difficult for many businesses to access traditional sources of funding, including bank loans, bonds, and public equity markets. As a result, non-bank lenders have stepped in to fill the void, providing much-needed financing to businesses that are struggling to secure funding elsewhere.

Rising demand for credit from SMEs

The demand for credit from SMEs has also contributed to the rise of private credit. SMEs are the backbone of many Asian economies, making up more than 96 per cent of all Asian businesses. [3] However, SMEs often struggle to secure financing from banks without suffering from higher transaction costs due to their size and lack of collateral. In contrast with traditional banks that are conservative in lending to SMEs, private credit providers are more willing to fund SMEs because they are less constrained by regulatory requirements and have more flexibility in their lending criteria than banks.

Growing appetite to invest in private credit

From investment perspective, private credit can be a good addition to a mature investment portfolio, given the downside protection that private credit offers through an attractive risk-return profile, diversification benefits, flexibility to negotiate for bespoke lender protection, resilience from its income-generating abilities and lower volatility.

This is particularly the case in times of cloudy economic outlook and soaring interest rates, as private credit, which typically embraces a floating interest rate, is more likely to hedge against inflation and offer higher yields than those in traditional fixed income and equity markets.

Private credit funds

What are the types of investments private credit funds make?

Generally speaking, they either directly originate private debt or they purchase loans on the secondary market. In the case where a fund directly originates a loan, we go into a territory of a highly-customised set of terms of the loan which often requires extensive negotiation between the fund and the borrower. In terms of investment strategies, it can range from any from senior debt, direct lending to real estate, high-yield and mezzanine.

Are private credit funds close or open-ended?

Credit funds can be closed-end funds, like a private equity fund, or open-end, like a hedge fund. In closed-end credit funds (which is the focus of the remainder of this article) where investors are generally not given the right to initiate withdrawals, capital commitments are raised over a fixed period of time and then those commitments are drawn down over time. A fund of this nature would look to distribute income from interests and principal payments on the loans and, in some cases, from realisations on the sale of loans. At the end of the day, like all funds, the nature of the debt drives the structure, and liquidity and structure of the fund would need to match the underlying assets.

The structures for close-ended funds in Asia are predominantly Cayman Islands-domiciled and the Cayman Islands exempted limited partnership remains a top choice, if not the gold standard, for managers and investments.

What are some of the features of private credit funds?

- Generally speaking, they have lower target returns than private equity funds because they are inherently less risky than equity. In the event of bankruptcy, creditors or lenders are paid back before equity holders.

- They are designed to have shorter terms than private equity funds to tie in with the underlying loans with finite maturity dates. Careful considerations are often required on the recycling provisions in order to ensure the intended term is maximised both from the manager’s and the investor’s perspective.

- Ideally, management fees reflect the full amount of the loan, rather than just the drawn portion because the full commitment amount is technically already invested whether they are drawn or not.

- Typically, credit funds undertake to distribute regular income on the back of regular interest and principal payments on the loans over the term of the loan received by borrowers, rather than only at the time of realisation of the underlying portfolio company, like in the private equity fund context.

The future is bright for Asian private credit

Despite the ongoing market volatility, the outlook for private credit’s continued growth in Asia’s debt financing scene is generally positive, largely due to borrowers’ heightened awareness of private credit and private credit firms’ sophistication in strategizing amongst direct lending, distressed debt, special situations, mezzanine debt as well as derivative instruments to provide timely and tailored credit support to borrowers in need.

Whilst historically private credit focuses on middle-market companies, the recent growth in fund sizes stands as proof that private credit has the capacity to finance larger deals while maintaining prudent fund diversification parameters. It has also enabled innovative approaches to better meet borrower needs, including the emergence of unitranche transaction where the lender issues a single credit instrument in replacement of a more complex capital structure that would subdivide the borrowed amount into junior and senior tranches of debt.

[3]https://www.adb.org/publications/role-smes-asia-and-their-difficulties-accessing-finance