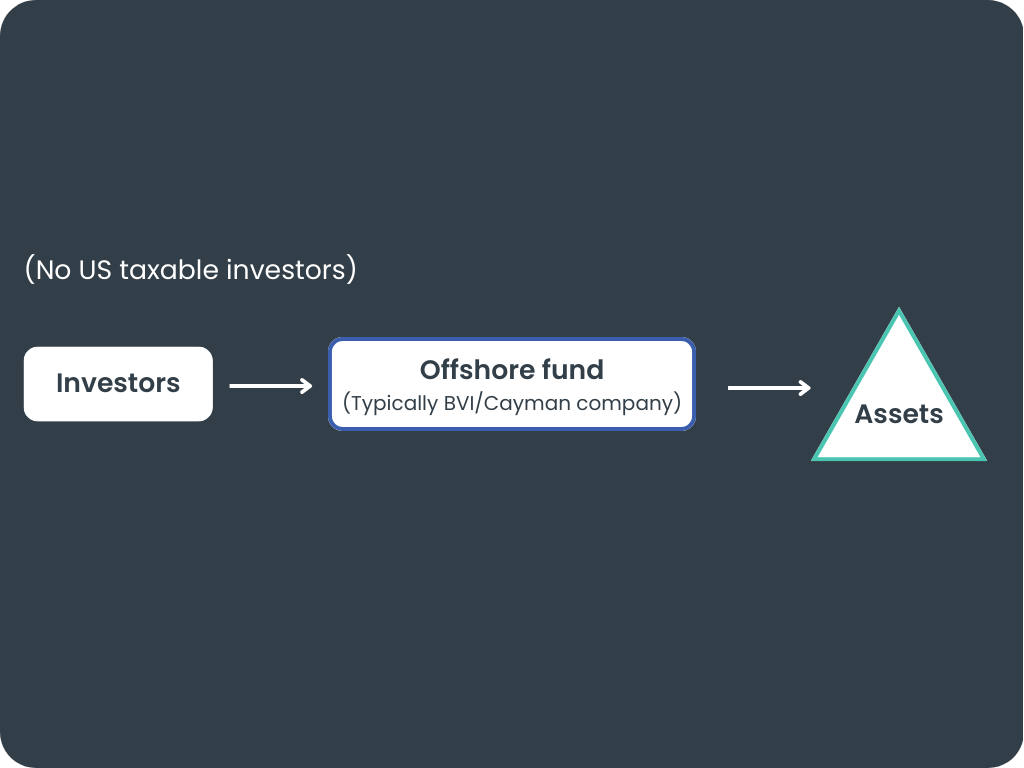

This is the most common structure and benefits from the flexibility of BVI corporate law. A BVI Business Company is a separate legal entity from the investing shareholders. The shareholders of a BVI Business Company have no direct legal or beneficial interest in any of the assets of the company which are instead legally and beneficially owned by the company itself. The BVI Business Companies Act provides a great deal of flexibility in terms of structuring funds. By way of example, there is no concept of “authorised capital” or “share capital” and therefore there is no longer a requirement for there to be any par value or capital attributed t ...

This is the most common structure and benefits from the flexibility of BVI corporate law.

A BVI Business Company is a separate legal entity from the investing shareholders. The shareholders of a BVI Business Company have no direct legal or beneficial interest in any of the assets of the company which are instead legally and beneficially owned by the company itself.

The BVI Business Companies Act provides a great deal of flexibility in terms of structuring funds. By way of example, there is no concept of “authorised capital” or “share capital” and therefore there is no longer a requirement for there to be any par value or capital attributed to shares. A company only has to state in its memorandum of association the maximum number of shares that it is authorised to issue. The directors may also designate different series of shares within each class without the need to amend the constitutional documents of the fund, giving a great deal more flexibility to funds wishing to use series accounting techniques to achieve equalisation of performance fee allocations among shareholders.

+-

+-  +-

+-  +-

+-  +-

+-  +-

+-  +-

+-  +-

+-  +-

+-