Exempted companies (ExCos) are companies that have been incorporated with limited liability and typically have a share capita.

ExCos are the most common form of structure used for traditional hedge and other open-ended funds. ExCos are regulated by their memorandum and articles of association as well as the provisions of the Companies Act (Revised).

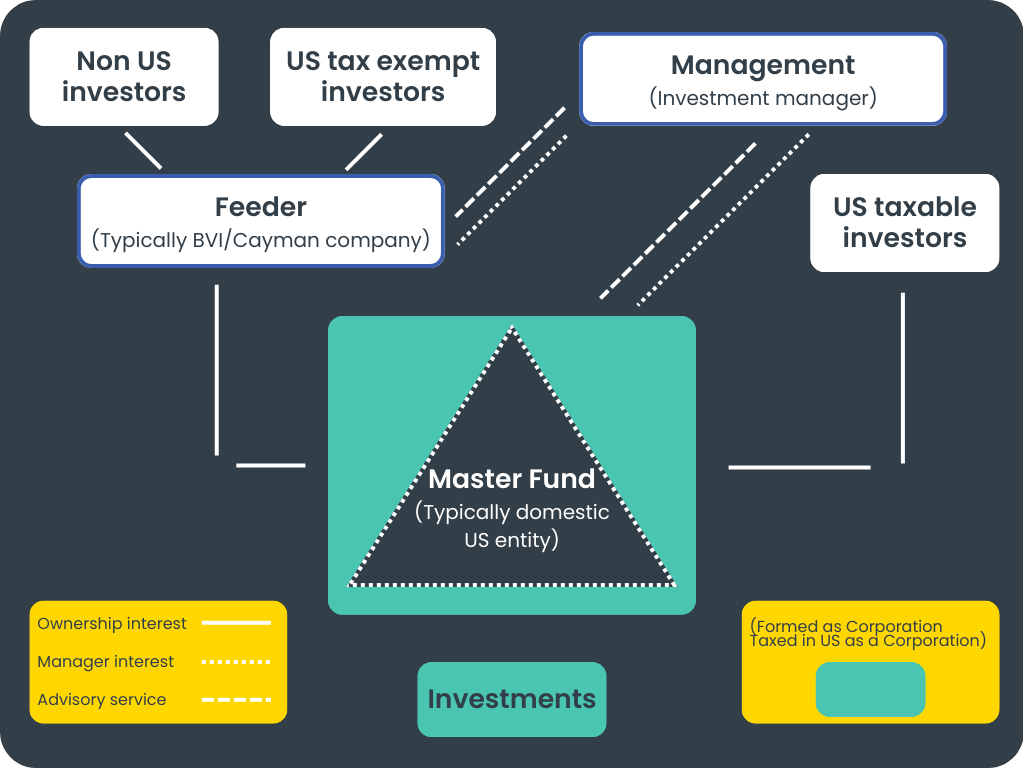

ExCo's management rests with its directors. Typically, investment management authority is delegated to an investment manager or adviser, although the relevant directors will always be required under generally applicable law to maintain oversight of the investment manager’s functions.

...Exempted companies (ExCos) are companies that have been incorporated with limited liability and typically have a share capita.

ExCos are the most common form of structure used for traditional hedge and other open-ended funds. ExCos are regulated by their memorandum and articles of association as well as the provisions of the Companies Act (Revised).

ExCo's management rests with its directors. Typically, investment management authority is delegated to an investment manager or adviser, although the relevant directors will always be required under generally applicable law to maintain oversight of the investment manager’s functions.