Go to

Go to

Classification made easy for FATCA & CRS compliance

Don't risk non-compliance with FATCA and CRS regulations. Use our CRS & FATCA Entity Classification Solution today to simplify your entity classification process and ensure you meet all your regulatory obligations.

As a business owner or director of a BVI or Cayman entity, compliance with FATCA and CRS regulations is crucial to avoid legal and financial consequences. Our CRS & FATCA Entity Classification Solution simplifies this process for you, so you can focus on your business operations.

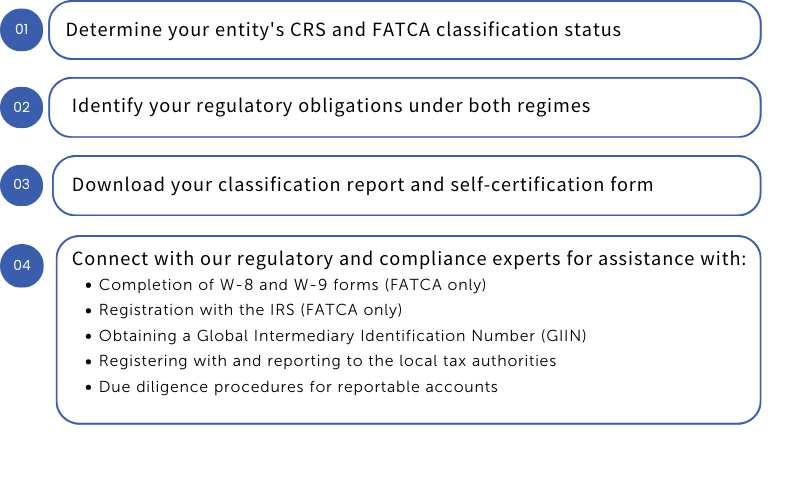

How does it work?

Easy and efficient classification process

Our solution provides a straightforward approach to entity classification. By guiding you through a series of yes-or-no questions, we make sure that you receive accurate results quickly without any complicated or time-consuming steps. Once the solution determines your entity's classification status, you can download your self-certification form and classification results with ease.

Seamless assistance from compliance experts

If our solution determines that your entity has ongoing regulatory obligations, our team of regulatory and compliance experts are ready to provide additional assistance. You can easily connect with them for any questions or concerns you may have about your regulatory obligations.

Overview of your regulatory obligations

Our solution gives you an overview of your entity's regulatory obligations. You can easily access and review your classification results and self-certification form at any time, ensuring you are always ahead of the game regarding regulatory compliance.

Why self-certification matters

Even if your entity is classified as having no ongoing regulatory obligations, you may still need to self-certify your entity's classification status when dealing with Financial Institutions such as Banks, custodians, asset managers, certain types of funds, and insurance companies. These institutions are obligated to collect, review and report information about their account holders/investors. Our solution simplifies this process by making it easy for you to download your self-certification form.

Key features

Our CRS & FATCA Entity Classification Solution provides everything you need to ensure your entity's compliance with regulatory obligations:

Simple user interface

Easy to understand question and answer options.

Download and share results

Downloadable PDF of your classification results and self-certification form.

Regulatory obligations

Clear overview of your regulatory obligations based on classification results.

Compliance solutions

Seamless connection with our compliance and regulatory experts for bespoke solutions.

FAQ

Who needs to classify?

Who needs to classify?

Why do CRS and FATCA regimes exist?

Why do CRS and FATCA regimes exist?

What happens after classification?

What happens after classification?

Related content

Read more about the latest FATCA/CRS developments on our regulatory blog by clicking on the links below.